Ignoring the Rebalancing Investment Strategy?

/

Rebalancing is a key part of the investing process. It’s also one of the hardest strategies for an investor to commit to. That’s why it often goes ignored, despite the benefits it offers.

What is Rebalancing?

Rebalancing is the process of adjusting the asset allocation of a portfolio that’s gotten off track. It starts with a review of your current investment weightings to see if they’ve strayed from their original targets. If they have, then you may want to buy or sell assets to bring your portfolio back into balance.

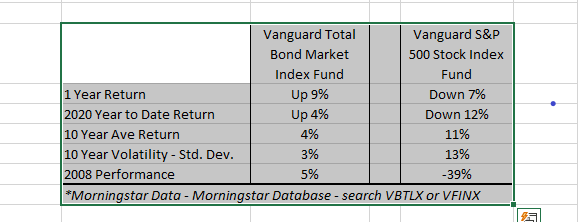

For example, say your original target asset allocation is 50% stocks and 50% bonds. After this past March’s market rout, you might find you are now at 45% stocks and 55% bonds. To reset the balance, you’d sell 5% of your portfolio value from bonds and use it to buy more stock funds.

Why Is Rebalancing Important?

Rebalancing plays a central role in managing a portfolio’s risk and return. Unless investors take action to boost underweight asset classes and trim overweight ones, actual portfolio behavior may differ from original portfolio goals. Most importantly, failing to rebalance exposes you to a risk return profile that deviates from your desired profile. In short: Careful investors rebalance.

Rebalancing Leads an Investor to Buy Low and Sell High

If you’re a disciplined investor who has set up asset allocation targets—and you review actual holdings to those targets—you’ll identify underperformers with ease. Despite their underperformance, embrace them, as they are key building blocks of your portfolio.

Remember that there was a reason you included them in the first place. As a sensible investor, it would be wise to add more money to them. Why? Because they are under-weighted and have under-performed. That means they’re a bargain that will pay off in the long run.

Here’s an example:

When I conducted a recent portfolio review for a client, it revealed that a rebalance would mean moving about 4% of her mix from investment-grade bonds into international stocks, both developed and emerging.

At the time, international stock categories were trading at Price to Earnings ratios of 30% or lower than the U.S. stock market. That’s like walking into a department store where everything is 30% off.

Also, the dividend yield on international stocks was nearly double that of U.S. stocks. This higher dividend payout is like a renter paying you twice as much as another tenant on your rental property.

With these benefits in mind, rebalancing the client’s portfolio seemed like a smart move.

Yet returns had been quite low on international stocks over the past 10 years. In fact, they’d produced a paltry 1-2% average return. Because of this, the investor hesitated to make the shift.

But what if international stocks reverted back to their historical return of 8-9%? The investor would miss out on significant returns and likely regret her inaction.

In the end, she did end up making the changes. I just had to educate her so she better understood the reasons behind my recommendation:

· First, I explained the importance of rebalancing.

· Second, I, reviewed the minor adjustment I was proposing.

· Third, I revisited international stock performance during the “lost” U.S. stock return decade of 2000-2010, where stocks averaged a -1% return while international outperformed at 6%.

This is what I meant earlier when I said rebalancing was a difficult strategy to commit to. Many investors simply don’t understand why it works and how it can benefit them.

Rebalancing May Improve Return

But wait ... rebalancing has yet another benefit: it may boost returns.

As proof of this, Vanguard completed a study in 2015 that confirmed rebalancing added about 0.5% a year to returns between 2005-2014.2 Half a percent might not sound like much, but it can amount to 10-15% higher asset values over several years on $100,000 invested. This can add $15,000 more money to your nest egg in later years.

Other studies suggest that rebalancing during certain time periods may further increase returns.

“In markets characterized by excess volatility, rebalancing holds the potential to boost returns,” said Investment Manager David Swensen in his book, Unconventional Success.1

Dimensional Fund Advisors, an investment management company led and driven by academic research, has a different take. They concluded that rebalancing might not boost returns but is relevant to maintaining risk.

While opinions differ on whether rebalancing improves return, all agree that it’s crucial in managing risk.

Rebalancing Ensures an Investor Stays True to Risk Tolerance and Capacity

Managing a portfolio is like walking a tightrope. When it’s well-structured, a balance exists between investment categories that allows investors to achieve their goals. Elements get added to the portfolio to either reduce risk or enhance returns.

When a portfolio is over-weighted in bonds, it increases the risk of too little return. This means a client may not have enough cashflow through the end of life.

When a portfolio is under-weighted in bonds, the client might face much steeper volatility during bear markets. In this past quarter, a 60% stock / 40% bond investment portfolio would have experienced an 8% decline compared to an 80% stock / 20% bond ratio with a 16% decline. That’s nearly double the decline in a bear market!

How Do You Rebalance a Portfolio?

The most cost-effective way to approach rebalancing is to work on maintaining asset allocation as money comes in and out of a portfolio. This can done using dollar cost averaging or distributions. If no money is being added or withdrawn, conduct a rebalance about once a year or after a portfolio has moved about 5%. Both techniques are equally effective.

When doing a rebalance, it’s important to keep an eye on tax implications. Thus, it may benefit you to conduct rebalancing in a tax-deferred account like an IRA.

Trading costs should also be a relevant factor. They lead you to assess the most efficient way to adjust the portfolio with the lowest number of trades. In times of extreme volatility, like bear and bull markets, rebalancers must also show unusual determination and fortitude.

In spite of the importance of rebalancing, investors appear largely indifferent to the process. In fact, it’s a point Swensen addresses in Unconventional Success: “Contrarian behavior lies at the heart of most successful investment strategies. Unfortunately for investors, human nature craves the positive enforcement that comes from running with the crowd.”1

Evidence indicates that, at best, investors allow portfolios to drift with the ebb and flow of the market. This may cause strong relative performance to increase allocations and weak relative performance to diminish holdings.

If you don’t have the discipline to rebalance, then doing nothing happens to be the next best option. The worst approach is when investors behave in a perverse fashion, deciding to add to strong performers and shun weak performers. Buying high and selling low provides a poor recipe for investment success.

As it turns out, there’s no reliable way to identify a market peak or bottom. Thus, the best strategy is to find an asset allocation you can live with, rather than making moves based on fear or speculation, even in the face of traumatic events.

At times it can be hard to stay the course. But remember, there are always alternatives.

If you’d like my help adjusting your holdings, please reach out. Meanwhile, stay safe and healthy.

References:

1. Swensen, David. (2005) Unconventional Success. Simon & Schuster. Pages 183-200.

McNamee, Jenna; Paradise, Thomas; Bruno, Maria. (April 10, 2019.) “Getting Back on Track: An Approach to Smart Rebalancing.” Vanguard Publications.

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investing involves risks. Wealthrise Financial Planning is an investment advisor registered with FINRA. This material is provided for informational and educational purposes only. It should not be considered investment advice or an offer to buy or sell securities.